Mode of taking or accepting certain loans, deposits and specified sum

August 7, 2020

Objective:

To curb the increasing cash transactions which are leading to accumulation of black money, the government had introduced section 269SS which restricts cash payments.

Provision:

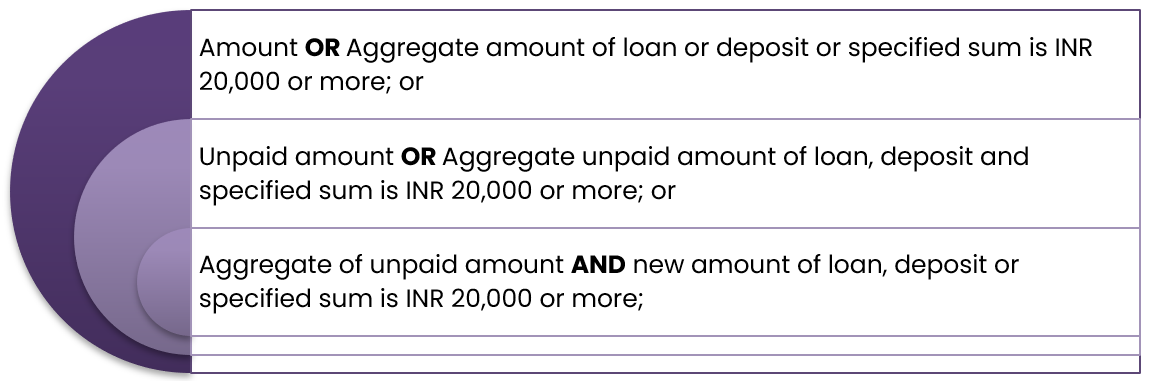

Any deposit, loan or specified sum should not be accepted or taken from any person other than by an account payee bank draft, account payee cheque or through electronic clearing system via bank account if

“Loan or deposit” would mean any loan or deposit of money.

“Specified sum” means any amount receivable in relation to transfer of immovable property such as earnest deposit, advance, etc…

Exceptions:

The section shall not apply in the below cases:

- If the receiver OR payer are the following parties

- Government

- Banking company, post office savings bank or co-operative bank

- Corporation established by a Central, State or Provincial Act

- Government company

- Other institutions as notified by the Government

- If the receiver AND payer have agricultural income and there is no other income which is chargeable to tax under this Act.

Consequences of violation:

In case of violation, section 271D prescribes the penalty which is equal to the amount accepted.

Illustrations:

| Scenario | Date of borrowing | Mode of borrowing | Amount borrowed | Amount already o/s | Total | Applicability of the section |

| A | 24-Sep-19 | Cash | 22,000 | – | 22,000 | Yes, on INR 22,000 |

| B | 14-Jun-18 | Cash | 30,000 | 10,000 | 40,000 | Yes, on INR 30,000 |

| C | 19-Oct-20 | Cash | 12,000 | 6,000 | 18,000 | No |

| D | 01-Jul-19 | Cash | 4,000 | – | 4,000 | No |

| 01-Oct-19 | Cash | 12,000 | 4,000 | 16,000 | No | |

| 01-Nov-19 | A/c payee cheque | 3,000 | 16,000 | 19,000 | No | |

| 01-Dec-19 | Cash | 2,000 | 19,000 | 21,000 | Yes, on INR 2,000 | |

| 30-Dec-19 | Cash | 500 | 21,000 | 21,500 | Yes, on INR 500 | |

| E | 06-Apr-18 | Interest accrued | – | 28,000 | 28,000 | Yes, on INR 28,000 |

Conclusion:

- In summary, it can be said that an individual is NOT allowed to accept loan, deposit or specified sum in CASH of INR 20,000 or more.

- The responsibility to comply with the section is on the ACCEPTOR of such loan, deposit or specified sum.