HUF – A tax effective tool?

August 21, 2020

What is a HUF?

-

A family under Hindu law consisting of all persons lineally descended from a common ancestor.

A family under Hindu law consisting of all persons lineally descended from a common ancestor. -

It cannot be created under a contract.

It cannot be created under a contract.

It is created automatically in a Hindu Family & comes into force as separate legal entity upon completion of certain formalities. Recognised all over India except in Kerala.

Recognised all over India except in Kerala.

It can be formed by Jains, Sikhs and Buddhists as wellWho can form HUF?

-

Married Couple (or) Members of a joint family, at least one of who should be a male member.

Married Couple (or) Members of a joint family, at least one of who should be a male member.

Single person cannot create HUF - Senior-most member of the family

- Manages the affairs of the HUF

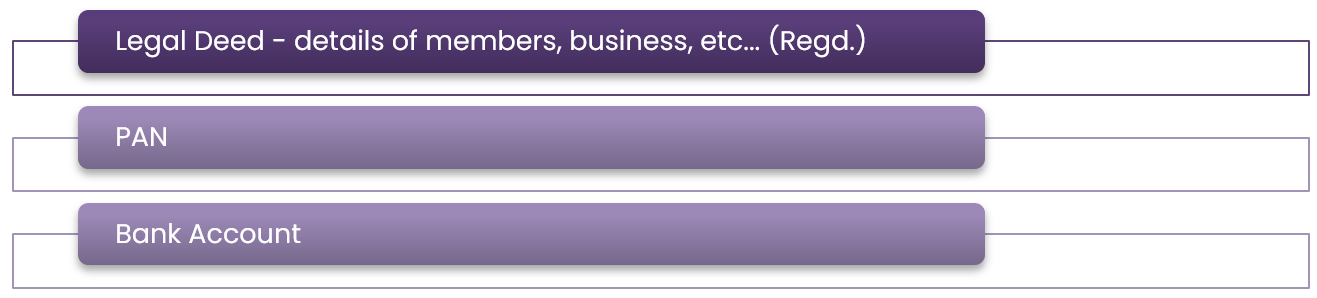

- Documentation

- Introduction of capital assets into HUF

- HUF has its own PAN

- Files separate tax returns

- Assessed in its own capacity

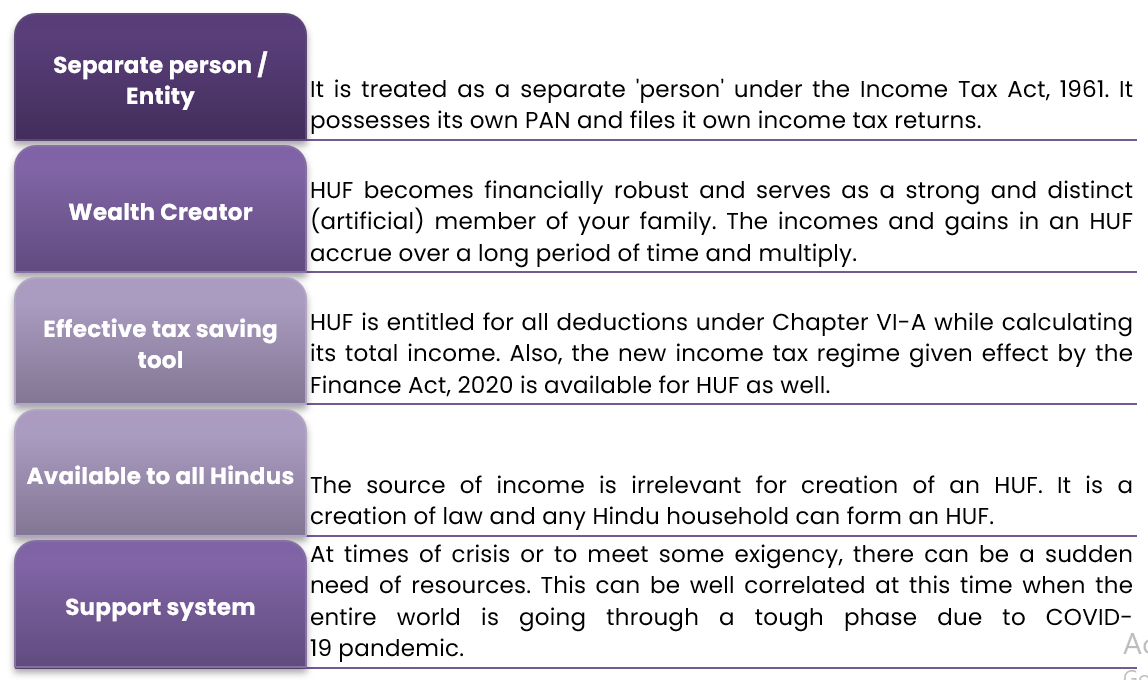

Taxpayers having both huge income under various heads of income and having moderate to high income from ancestral properties. If not for such income from ancestral property, they would either be under lower tax brackets or below the minimum taxable income and it is expected to remain the same in the long run.

Taxpayers having higher amount of savings, which if split between individual and HUF could provide for higher deduction.

If the members do not intend to split the ancestral property in the long run and want to continue holding it in the common pool, creating a HUF would be beneficial.

Considering the present day’s scenario where the joint family system hardly exists, creating smaller HUFs by nuclear families (parents and children) which is formed with a specific objective like child’s education, securing child’s future, etc… will be beneficial.

Structure of HUF & Share of each person in HUF:

Architecture Detail / Role Right to claim partition Share in HUF properties upon partition KARTA (Note 1) Yes Equal share COPARCENERS

(Note 2)A person in the family who acquires a right in the ancestral property by birth i.e. all lineal descendants of Karta including married daughters Yes Equal share MEMBERS (Note 2) Family members other than coparceners Eg. Spouse of the lineal descendants No No share but enjoys the HUF income Note1: Post the 2005 amendment, the SC has also further ascertained that Hindu woman’s right to be a joint legal heir and inherit ancestral property on terms equal to male heirs. Hence, it could be debated that on the death of Male Karta, the Karta could be senior-most female coparcener as well.

Note 2: A married woman will be a coparcener in her father’s HUF and member in father-in-law’s HUF.

How to form an HUF?

Method of introduction Tax Implication Partition of a larger HUF No tax implication if the asset is not treated as self-acquired property. Inheritance through a specific bequest under a will Since this is not a ‘transfer’, there is no tax implication. Reunion of separated coparceners Tax implications depends on the type of assets introduced. Receipt of gifts HUF is not an individual and hence has no relatives. If the value of the assets received as gifts in a year exceeds INR 50,000 it will be deemed as income of the HUF and taxed accordingly. Blending of individual property with the family hotchpotch Income derived by HUF from such property shall be clubbed to the income of transferor. (Section 64(2) of the Income Tax Act, 1961). Doing joint labour for the benefit of HUF Income earned from such labour shall be appropriately taxed in the hands of HUF Benefits of forming an HUF:

Disadvantages of forming an HUF:

Equal right in the property Once a property is assigned to an HUF, all coparceners have equal right to it. So, it cannot be transferred or sold without the consent of all coparceners, and even the Karta cannot transfer it to anyone without everyone’s consent. Breaking is not as easy as formation HUF cannot be broken into parts; all members have to agree to dissolve an HUF Every lineal descendant shall be a part of HUF Since all lineal descendants are part of an HUF, every child, whether boy or girl, who gets added to the family, becomes a part of the HUF Procedural Compliances Since HUF is a separate legal entity, there is an additional burden of procedural compliances under IT Act. Further, the HUF shall be assessed and monitored by IT Authorities. The income pattern of an HUF is often questioned by income tax officers. NRI Issues HUFs are an Indian phenomenon; some family members move abroad either to study or work and the computation of income may be difficult as many countries do not recognize HUF. “The computation of income in such cases is still a grey area Clubbing of income While introducing assets into HUF or any other action pertaining to HUF, one has to be very careful about attracting clubbing provisions Will HUF property cannot be mentioned in the Will. Taxability of HUF:

Illustration:Particulars Taxability Separate legal entity Rate of taxation Same as applicable to a resident individual not being a senior citizen. Income HUF can have all types of income except salary income. Returns on investments made from HUF’s income Assessed in the hands of HUF Deductions & exemptions Eligible, if such deduction or exemption is technically allowed for a HUF. Salary to HUF members Allowed and deductible provided they contribute to the functioning of HUF. Fees or remuneration derived by a member as director of a company or partner of a firm, in his representative capacity as member of HUF Taxable as income of HUF Clubbing provisions (Section 64(2)) Any personal funds or property given by an individual to the HUF will lead to clubbing of such income in the hands of the individual. Let us understand the taxation with an example. After the death of Mr. A’s father, he decides to start a HUF with his wife, son, and daughter as members. Since Mr. A had no siblings, the property held by his father was transferred in the name of the HUF. The property earns an annual rent of INR 7.5 lakhs. Mr. A has an income from salary of INR 20 lakh. By creating a HUF, Mr. A can save tax as seen below.

Income from various sources Income of Mr. A before formation of HUF Income of Mr. A after formation of HUF Income of HUF Salary 20,00,000 20,00,000 – Less: Standard deduction 50,000 50,000 – Income from Salaries (A) 19,50,000 19,50,000 – House property rent 7,50,000 – 7,50,000 Less: Standard deduction on house property 2,25,000 – 2,25,000 Income from house property (B) 5,25,000 – 5,25,000 Total taxable income (A+B) 24,75,000 19,50,000 5,25,000 Section 80C 1,50,000 1,50,000 1,50,000 Net taxable income 23,25,000 17,00,000 3,75,000 Tax payable (Tax + Cess) 5,30,400 3,35,400 6,500 Total tax paid by Mr. A & HUF 3,41,900 Tax saving due to forming an HUF 1,88,500

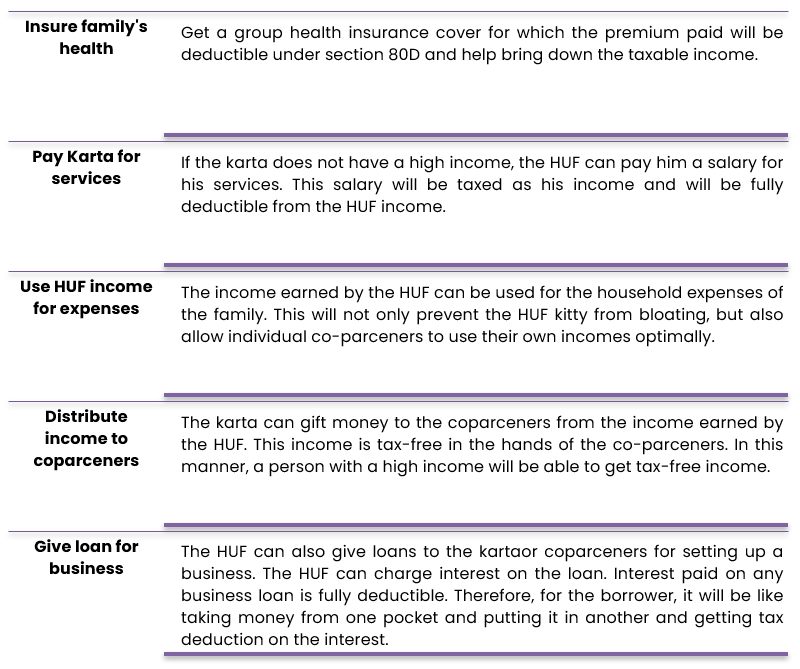

Tax Planning Strategies:

The following are some notable tax-planning options regarding HUF:

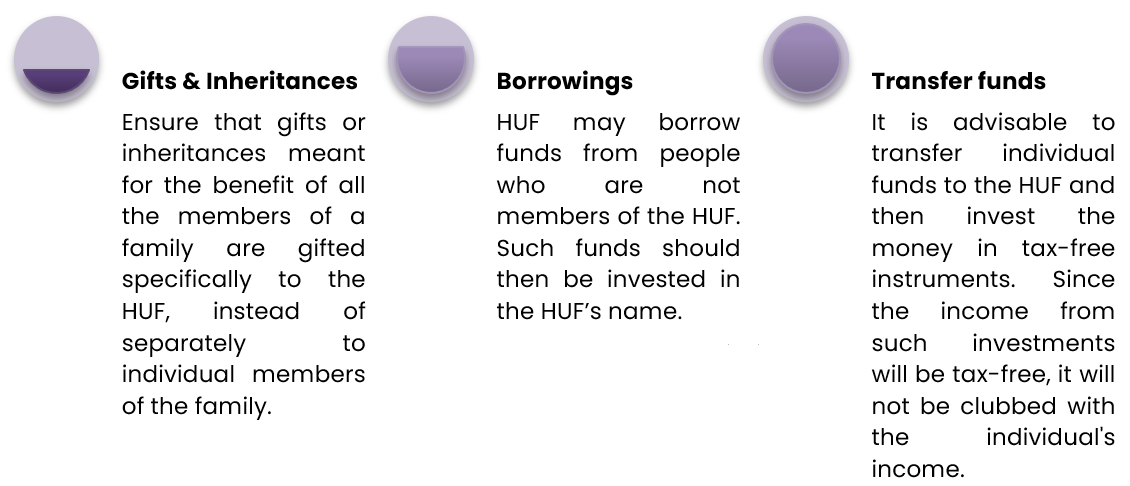

Ways to boost the property of an HUF:

Partition of HUF and taxability thereof:

Partition is the severance of the status of the Joint Hindu Family, known as HUF under tax laws.Particulars Explanation Assessment under the Act (Sec 171) Total Partition All the members cease to be members of the HUF and all the properties cease to be properties belonging to the said HUF. The Income under consideration till date of partition will be assessed as income of HUF and thereafter in the hands of individual’s coparceners after partition. If any recipient of income after partition forms another HUF with his wife and son/s then the income will be assessed in the hands of the new HUF. Partial Partition It may be partial vis-a-vis members, where some of the members go out on partition and other members continue to be the members of the family. It may be partial vis-a-vis properties where, some of the properties, are divided among the members other properties continue to be HUF properties. Partial partition may be partial vis-a-vis properties and members both. In order to be acceptable or recognizable partition under section 171, a partition should be complete partition with respect to all members of HUF and in respect to all properties of HUF and also there should be actual division of property as per defined / specified shares allotted to each individual member of HUF property. Death of coparcener A death of a member / coparcener cannot bring about an automatic partition and on such a death, the other surviving members continue to remain joint. However, under the provisions of 56 of Hindu Succession Act, there is a deemed partition for a limited purpose of determining the share of the deceased co-parcener for the purpose of succession under the Act.

Conclusion:

Though the cons outweigh the pros, however, in certain scenarios it is worth taking the risk. The basic structure and the features of HUF make it a tax effective tool in the following scenarios: