Basic GST Insights for Small Business Owners

September 20, 2021

The GOI implemented the Goods and Services Tax (GST)on July 01, 2017, as an initiative towards “One Nation – One Tax”. Yes, the main rationale behind this Act was to replace the myriad of indirect taxes that were in play like the Value Added Tax, Service Tax, Central Sales Tax, Central Excise, Octroi, Entertainment Tax, etc. All these were added at various levels of the products/services hence adding to the MRP of the product.

2021 marks the 4th year of GST and still there are a lot of hustles, misconceptions and doubts amongst the common public. This article focuses on how GST impacts a small business and what is the basic understanding that a proprietor or a start-up or a small firm has to have in mind while dealing with GST.

1. Should I register under GST as soon as I start my business?

No. GST registration is required mandatorily under the following circumstances:

2. Can I register under GST even if I do not fall under any of the above categories?

Yes. Apart from the above, any individual who forecasts his business to exceed the turnover during the business can voluntarily register under GST.

Agriculturists are out of the ambit of GST. However, the exemption is only to the extent of supply of produce out of cultivation of land.

3. What is the list of documents required for registration?

| Proof of ID | Proof of Business | Poof of Address | Bank a/c details | Authorisation |

|---|---|---|---|---|

| a. PAN b. Aadhar | a. Certificate of incorporation b. Partnership agreement | a. of the proprietor / partner / director b. Place of business | a. Bank statement b. Cancelled cheque | a. Letter of Authorisation by other partners b. Board Resolution |

4. How do I make my customers know that I have registered under GST?

Once the GSTIN – Goods and Service Tax Identification Number has been allotted on successful registration, your responsibility to comply with GST regulations begins; the first step being structuring of your tax invoice. The GST regime mandates the issue of tax invoice for every supply of goods or services.

Why is a tax invoice important? – It is an essential document for your customers to avail Input Tax Credit. No registered person can claim/avail input tax credit unless he is in possession of a tax invoice or a debit note.

5. What are the contents of a tax invoice?

The following are the mandatory fields in framing a tax invoice:

6. Is e-invoicing mandatory?

E-invoicing is a method of invoicing where the invoices for B2B customers will be raised and synced on the portal. This is applicable for registered users having aggregate turnover above Rs. 50 crores w.e.f April 01, 2021.

However irrespective of the turnover limit, the following registered users are mandatorily required to comply with e-invoice:

7. What is ITC and how do I claim my ITC?

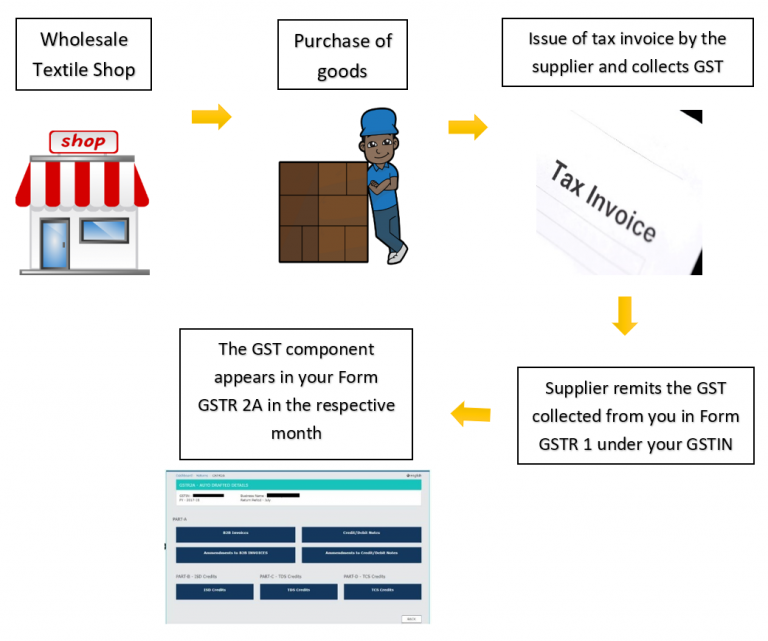

In layman terms, input Tax Credit – ITC means the credit of GST paid on purchase of goods and services which are used for the furtherance of business.

In turn, when you sell the goods to your customers, you collect GST and remit on behalf of them. At the time of remittance, the GST input available in Form GSTR 2A shall be adjusted against your output tax liability and the balance shall be remitted to the Government.

A regular taxpayer could claim provisional ITC in GSTR-3B only to the extent of 5% of the ITC available in GSTR-2B till 31.12.2021. It means the amount of ITC reported in GSTR-3B will be a total of actual ITC in GSTR-2B and provisional ITC being 5% of actual ITC in GSTR-2B. However, with effect from 01.01.2022, businesses can avail ITC only if it is reported by supplier in GSTR-1/ IFF and it appears in their GSTR-2B. Due to this amendment, the taxpayers may have to

- Match purchase register with GSTR-2B regularly (weekly).

- Include additional clauses in their contracts relating to delayed vendor payments in case GST is not appearing on the portal.

- Plan their finances as this may lead to cashflow issues and shortage of working capital.

- Regularly follow up with their vendors if the GST filing is done on time.

A major and a positive change due to this amendment is that irregular taxpayers will be forced to file their returns on time due to the fear of losing business from big companies, thus bringing them all under the GST net.

8. What is the manner of setting off of ITC?

|

IGST output |

CGST output |

SGST / UTGST output |

|

IGST input |

IGST input |

IGST input |

|

CGST input |

CGST input |

SGST / UTGST input |

|

SGST / UTGST input |

|

|

IGST input available is to be exhausted mandatorily before setting off the CGST, SGST/UTGST input.

9. Can I claim ITC on any kind of expense I incur?

The Government has restricted availing inputs on certain goods and services even if incurred for the purpose of business commonly known as BLOCKED CREDIT. An illustrative and common list of the same are::

ü On purchase of Motor Vehicle and other conveyance

ü Food and beverages, outdoor catering

ü Beauty treatment, health services, cosmetic and plastic surgery

ü Membership of club or fitness centre or health centre

ü Rent-a-cab service

ü Health Insurance & life insurance

ü Goods/Services on which GST is paid under composition scheme

ü Works contract services, supplied for construction of immovable property

ü Any expense for personal consumption

Considering the ongoing pandemic, the GOI has mandated to incur expenses such as sanitizing business premises, medical insurance, food & beverages, for the safety and welfare of the employees. Even though ITC on such expenses is not allowed in the normal circumstances, relaxation to claim ITC is given considering the pandemic. Refer our previous article tilted – “Input Tax Credit on safety measures during the pandemic” (https://dshandassociates.com/input-tax-credit-on-safety-measures-during-the-pandemic/).

10. What is the GST returns I should file and when should I file?

GST return filing is an online process. A registered person must file his returns on the common portal www.gst.gov.in. The returns are framed aiming to cover the following aspects – a) Sales; b) Purchases; c) Output GST (on sale); d) Input GST (on purchase)

Below are the list of common GST returns to be filed and the due dates:

|

Name of the Return |

Purpose of the Return |

Who should file |

When to file |

|

Form GSTR 1 |

Captures the Outward Supplies of taxable goods and services in that period |

Persons/Businesses having aggregate turnover > 1.5 crores in a year |

Monthly i.e., 11th of every subsequent month (For ex: July’s GSTR1 to be filed on 11th of August) |

|

Form GSTR 1 (QRMP) |

Captures the Outward Supplies of taxable goods and services in that period |

Persons/Businesses having aggregate turnover < 1.5 crores in a year |

Quarterly i.e., 13th of every succeeding quarter (For ex: Q1’s GSTR1 to be filed on 13th of July) |

|

Form GSTR 3B |

Summary of the Outward Supplies and the ITC claimed and the payment of tax is affected |

Persons/Businesses having aggregate turnover > 1.5 crores in a year |

Monthly i.e., 20th of every subsequent month (For ex: July’s GSTR3B to be filed on 20th of August) |

|

Form GSTR 3B (QRMP) |

Summary of the Outward Supplies and the ITC claimed and the payment of tax is affected |

Persons/Businesses having aggregate turnover < 1.5 crores in a year |

Quarterly i.e., 22nd of every succeeding quarter (For ex: Q1’s GSTR3B to be filed on 22nd of July) |

|

Form GSTR 9 |

Annual Return |

All GST registered Tax Payers having aggregate turnover > 2 crores |

Annual – Due date as declared by the GST Department |

|

Form GSTR 9C |

Certified Reconciliation Statement |

To be filed by a Chartered Accountant who are required to file GSTR 9 |

Annual – Due date as declared by the GST Department |

11. What if I miss my return filing due date or do not file returns for a long time?

Non filing or late filing of returns follow with strict penalties and interests which one cannot get away with.

Late Fee for non-filing of Form GSTR 1 & Form GSTR 3B by the prescribed due dates – Rs. 25 per day per act (in case of NIL return – Rs. 10 per day per act)

Maximum Late Fee per return is restricted to:

ü In case of NIL Returns – Rs. 500 per return, i.e., Rs. 250 for CGST and Rs. 250 for SGST

ü Other than NIL Returns – If the Turnover in the previous Financial Year is:

o Upto Rs. 1.5 Crores – Rs. 2,000 per return

o Rs. 1.5 Crores to Rs. 5 Crores – Rs. 5,000 per return

o More than Rs. 5 Crores – Rs. 10,000 per return

Late Fee for non-filing of Form GSTR 9 by the prescribed due dates – Rs. 100 per day per act subject to a maximum of 0.25% of the Turnover for the Financial Year.

- Late fee will always be applied on the subsequent month’s payable and it has to be paid via cash only. Late fee cannot be set off using ITC.

- Late fee cannot be evaded as it is auto populated in the portal at the time of payment.

- GST Amnesty Scheme – Taxpayers can file pending Form GSTR 3B from July 2017 to April 2021, on or before 30.11.2021 with a reduced maximum late fee.

12. Can I cancel my GST registration? When can the department cancel my GST registration?

Cancellation of registration can be under two circumstances:

Voluntary Cancellation: A taxpayer can request for cancellation voluntarily under following circumstances:

ü Business has been discontinued.

ü Business has been transferred/amalgamated/disposed.

ü Change in the constitution of the business.

ü Turnover falls below the required limit.

Mandatory Cancellation: A Tax Officer is authorized to cancel a registration of a taxpayer under following circumstances:

ü Does not conduct business from the declared place of business.

ü Issues invoice without supply of goods/services.

ü Violation of the anti-profiteering provisions such as not passing on the ITC.

ü Utilisation of ITC from Electronic Credit Ledger to discharge more than 99% of tax liability when taxable value of supplies exceeds Rs. 50 lacs in a month.

ü A taxpayer who has defaulted in filing Form GSTR 1 and Form GSTR 3B for more than 2 consecutive months.

ü Avails ITC in violation of the provisions of the act.

Conclusion:

Although, the compliance burden has increased with an ever-increasing number of amendments, notifications and clarifications, having a GST registration is always useful for establishing your brand as trustworthy and an authentic one in a marketplace. Being GST registered not only recognises you in the organised sector but also is the first step in managing your company taxes efficiently while maintaining a clean record.

Disclaimer:

The above is a very brief writeup and solely for educational & information purposes only. It does not constitute an advice or a legal opinion or personal views. There may be possibility of different view on the various subject matter discussed.