The One-Man Show – One Person Company

February 6, 2022

The Companies Act, 2013 brought in several new revolutionary concepts which did not exist previously and one such concept is One Person Company (OPC). The induction of this is OPC in India was given in the Dr J.J Irani Committee Report dated May 31, 2005. It is the recognition of single person economic entity lightens a path for small traders and other service providers to venture into business by expanding their opportunities, limiting their liability with minimal procedural compliances.

1. What is an OPC?

Section 2(62) of the Companies Act, 2013 defines a one-person company as a company that has only one person as to its member. So, an OPC is effectively a company that has only one shareholder as its memb1er.

The words One Person Company must be mentioned below the name of the company in bracket wherever it appears.

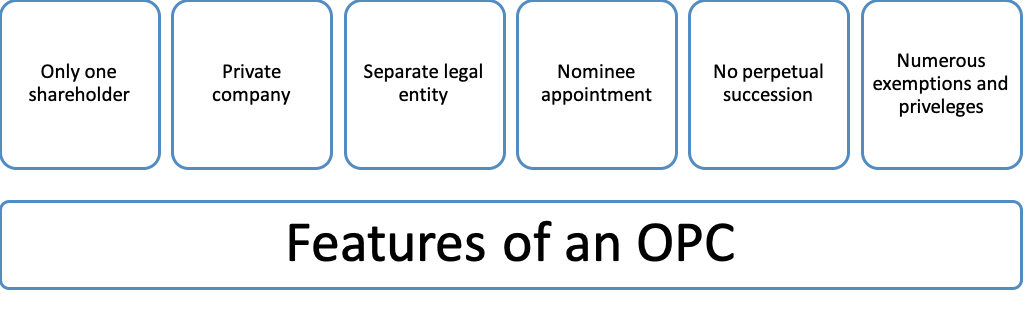

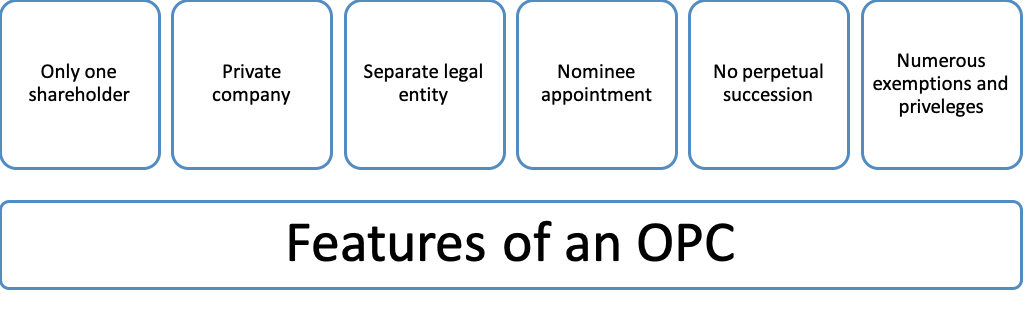

2. What are the characteristics of an OPC?

- The shareholding of an OPC is limited to individuals. A natural person who is an Indian citizen whether a resident or not i.e. NRI shall be eligible to incorporate an OPC. The timeline of stay in India for NRI has been reduced from 180 days to 120 days.

- The Act classifies OPC as a private limited company for the sake of all the legal purposes. All the provisions related to a private limited company is applicable to an OPC, unless they are expressly excluded by an independent clause.

- The minimum and maximum no. of members in OPC can be only one (1). The Minimum no. of directors – one (1); Maximum no. of directors – fifteen (15).

- An OPC cannot conduct the business of Non-Banking Financial Investment activities including investment in securities of any other body corporate.

- An OPC cannot be incorporated or converted to a section 8 company.

- Given that an OPC can have only one shareholder, this would mean it cannot raise funds by way of issuance of shares or convertible instruments and cannot issue sweat equity shares or ESOPs until it converts itself into a private or public limited company.

3. What are the privileges and exemptions given to an OPC under the Act?

- There is no requirement of minimum paid-up share capital.

- They do not have to hold AGM.

- Their financial statements need not include cash flow statements.

- Provisions relating to independent directorsdo not apply to them.

- Several provisions relating to meetings and quorum do not apply to them.

- Mandatory rotation of auditor after expiry of maximum term is not applicable.

4. What are the provisions relating to appointment of nominee for an OPC?

The sole member needs to appoint one person as a “Nominee” in the event of death, incapacity, etc… during the incorporation of the company which is a unique feature to OPCs. A written consent to this effect must be obtained at the time of registration from the nominee in Form INC – 3 – Nominee Consent Form.

The death of the only member of the company allows the nominee to either reject or choose to become its sole member. The Nominee becomes the member of the company, is entitled to all the shares of the OPC and bears all the liabilities.

In case the nominee withdraws his consent, an intimation needs to be made to ROC through Form INC – 4 – Change in Member/Nominee and another nominee needs to be appointed within 15 days of the receipt of the withdrawal notice.

5. Whether an OPC can be converted to a public / private limited company?

An OPC can be converted to a public / private limited company either voluntarily or mandatorily. Once the OPC exceeds the below threshold limits, it needs to mandatorily convert itself into a public / private limited company

- Paid-up share capital of OPC > Rs. 50 lakhs OR

- Average Annual turnover of preceding 3 financial years > Rs. 2 crores.

The company shall file an application in Form INC-6 – Application for Conversion for its conversion into Private or Public Company, other than under section 8 company.

The following documents need to be attached

- Altered MOA and AOA

- Copy of Resolution

- The list of proposed members and its directors along with consent

- List of creditors

- Latest audited financial statements.

6. What are the mandatory compliance requirements for an OPC?

- At least one Board Meeting in each half of the calendar year and the time gap between the two Board Meetings should not be less than 90 days

- Statutory audit of financial statements

- Filing of Form AOC-4 and Annual Return in Form MGT 7-A.

7. What is the difference between an OPC and Sole Proprietorship?

| Particulars | One Person Company | Sole Proprietorship |

|---|---|---|

| Separate Legal Entity | OPC is distinctive from its promoter has its own liabilities and assets | The sole proprietorship and its proprietor is the same |

| Liability | Limited | Unlimited |

| Giving loans and renting of property | OPC proprietor can give loan to the company or rent its property to the company for a consideration | A sole proprietor cannot give loan or rent its property as there is no separate legal entity |

| Income tax | Rate applicable to a private limited company | Rate applicable to the sole proprietor i.e slab rate wise |

Conclusion:

In layman terms, an OPC is a corporate form of a sole proprietorship. An OPC is an excellent option for sole proprietors as it offers them the key benefit of limiting their liability. The organized version of OPC will open the avenues for more favourable banking facilities. It gives suppliers and customers a sense of confidence in business due to the legal status and hence gives a social recognition to the business.

Disclaimer:

The above is a very brief writeup and solely for educational and informational purposes only. It does not constitute an advice or a legal opinion or any personal views. There may be possibility of a different view on the various subject matter discussed.