Tax Deducted at Source – Individuals & HUF

March 19, 2022

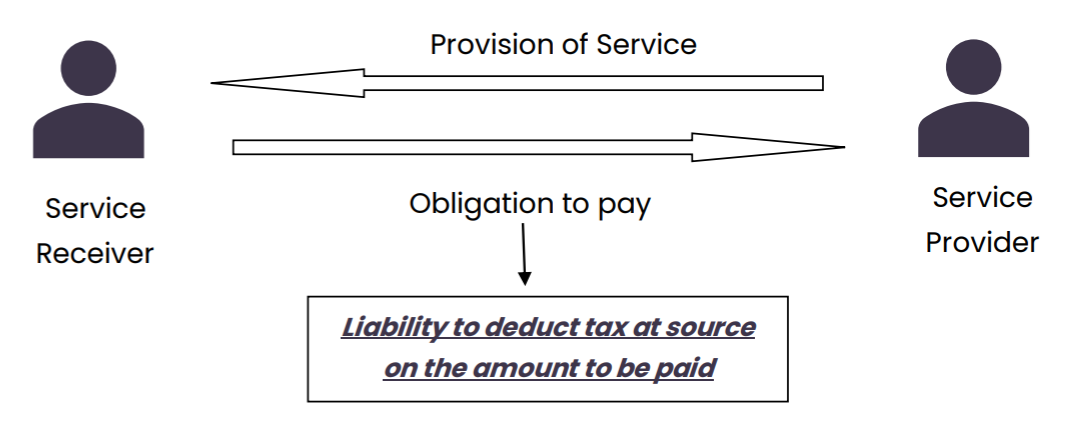

TDS or Tax Deducted at Source is the income tax reduced from the money paid at the time of making specified payments such as rent, commission, professional fees, salary, interest etc. by the persons making such payments. TDS is a form of taxation at source (i.e. a payer’s obligation) instead of taxing the same in the hands of the recipient.

Below is a chart which shows the responsibility of the individual and HUF to deduct tax:

| TDS applicable to an Individual or HUF who is liable for Tax Audit | |||

| Section | Particulars | Threshold | Rate |

| 194C | Payment for contract work | Single payment in excess of Rs. 30,000/- or an aggregate of Rs.100,000/- during the relevant FY | 1% or 2% |

| 194J | Professional Services | Single payment or aggregate of payments during the relevant FY in excess of Rs.30,000/- | 10% or 2% |

| 194H | Commission or brokerage | Single payment or aggregate of payments during the relevant FY in | 5% |

| excess of Rs.15,000/- | |||

| 194S | Transfer of Virtual Digital Assets (w.e.f 01/04/2022) | Consideration payable > Rs.10,000/- | 1% |

| 194R | Any benefit or perquisite provided to a resident, which has arisen out of the business or profession and taxed as income as per s.28(iv) – (w.e.f 01/04/2022) | Value or aggregate value of the benefit or perquisites > Rs.20,000/- during the Financial Year | 10% |

| TDS applicable to an Individual or HUF who is NOT liable for Tax Audit | |||

| Section | Particulars | Threshold | Rate |

| 194M | Contractual work or Professional Services or Commission or Brokerage | Single payment or an aggregate of such payments in excess Rs. 50,00,000/- during the relevant FY | 5% |

| 194S | Transfer of Virtual Digital Assets (w.e.f 01/04/2022) | Consideration payable > Rs.50,000/- | 1% |

| TDS applicable to all types of Individuals & HUF | |||

| Section | Particulars | Threshold | Rate |

| 194-IB | Payment of Rent | Monthly rent in excess of Rs. 50,000/- to a Resident Indian | 5% |

| 194Q | Purchase of any goods | Value of the goods or aggregate of such value > Rs.50,00,000/- in any previous year | 0.1% |

| 194-IA | Payment in consideration of transfer of certain immovable property other than agricultural land. | Consideration > Rs. 50,00,000/- | 1% |

| 192 | Payment of Salary | In excess of taxable limit | Slab Rate |

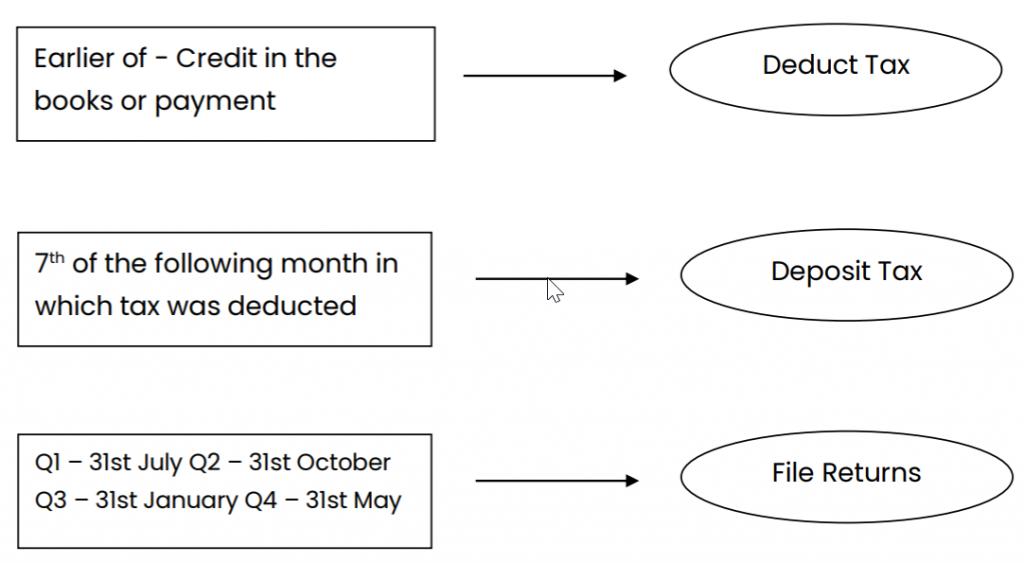

TDS deduction, deposit & reporting procedure:

| Form No | Transactions | Due Date |

| 24Q | TDS on Salary | Q1 – 31st July Q2 – 31st October Q3 – 31st January Q4 – 31st May |

| 26QB | TDS on sale of property | 30 days from the end of the month in which TDS is deducted |

| 26QC | TDS on rent | 30 days from the end of the month in which TDS is deducted |