Will you gain by switching to new IT regime?

July 25, 2020

The Budget 2020 announced by our Finance Minister Mrs. Nirmala Sitharaman introduced a new tax regime for individuals and HUFs by widening the income tax slabs and reducing rates while taking away most of the exemptions and deductions being availed. Section 115BAC has been introduced with a paradigm shift in the way individuals and HUFs will be taxed. The provisions of the section are tabulated below for easy reference.

| Sl. No. | Particulars | Details | ||||||||||||||||

| 1. | Applicability | Optional scheme for Individuals and HUFs w.e.f AY 2021-22 | ||||||||||||||||

| 2. | Tax rates |

|

||||||||||||||||

| 3. | Deductions forgone (illustrative) |

|

||||||||||||||||

| 4. | Other conditions |

|

||||||||||||||||

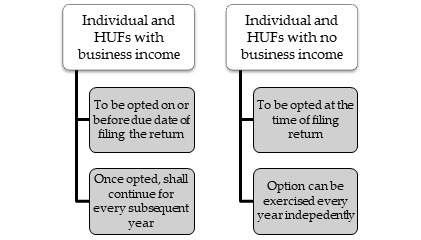

| 5. | Time for availing new regime |  |

Illustration:

- Taxpayer with fewer deductions and exemptions:

Particulars Old regime New Regime Annual Income 800,000 800,000 Standard deduction (50,000) – HRA (30,000) – LTA (25,000) – Chapter VI-A – EPF contribution (25,000) – Taxable income 670,000 800,000 Taxes 46,500 45,000 Cess 1,860 1,800 Total taxes 48,360 46,800 Total taxes saved 1,560

- Taxpayer with major deductions and exemptions:

Particulars Old regime New Regime Annual Income 20,00,000 20,00,000 Standard deduction (50,000) – HRA (50,000) – LTA (25,000) – Chapter VI-A- - 80C

- 80D

- 80CCD

(150,000)(25,000)(30,000)– Taxable income 16,70,000 20,00,000 Taxes 3,13,000 3,37,500 Cess 12,540 13,500 Total taxes 3,26,040 3,51,000 Excess tax payable 24,960

In summary, the new tax regime is beneficial for that taxpayer who has not significantly invested in tax-saving schemes. However, taxpayers who have invested in various tax-saving schemes may continue to opt the old tax regime as it allows to claim all various deductions and exemptions. The new regime has given an option to taxpayers to plan their taxes judiciously.

Conclusion: Calculate all your deductions and exemptions carefully to opt the better tax saving scheme. However, the new tax regime does not provide incentive to save and such individuals loose on the financial safety and security and end up saving less.