Audit of accounts of certain persons carrying on business or profession – Tax Audit

August 8, 2020

It is an examination or review of accounts of a business or profession carried out by taxpayers from the perspective of INCOME TAX which is to be conducted by a Chartered Accountant in full time practice.

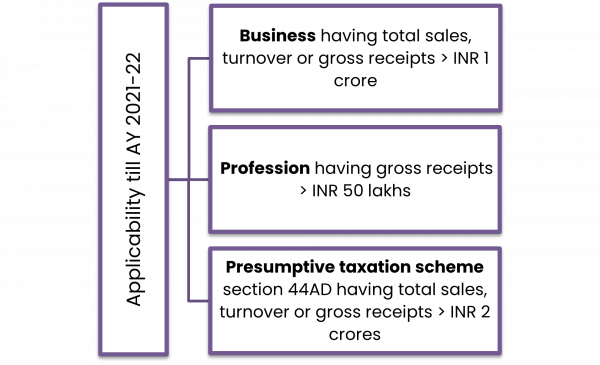

Applicability:

To reduce the compliance burden on small and medium enterprises, the budget 2020 introduced a proviso for taxpayers carrying on business w.e.f. AY 2021-22. The threshold limit of INR 1 crore has been increased to INR 10 crores (w.e.f AY 2021-22) in cases where:

- Total cash receipts do not exceed 5% of the total receipts or turnover; AND

- Total cash payments do not exceed 5% of the aggregate payments.

Note:

The amendment is made only for taxpayers carrying on business and not for professionals. Further, the receipts may include all kinds of business receipts like sale of depreciable assets or any other receipt of similar nature.

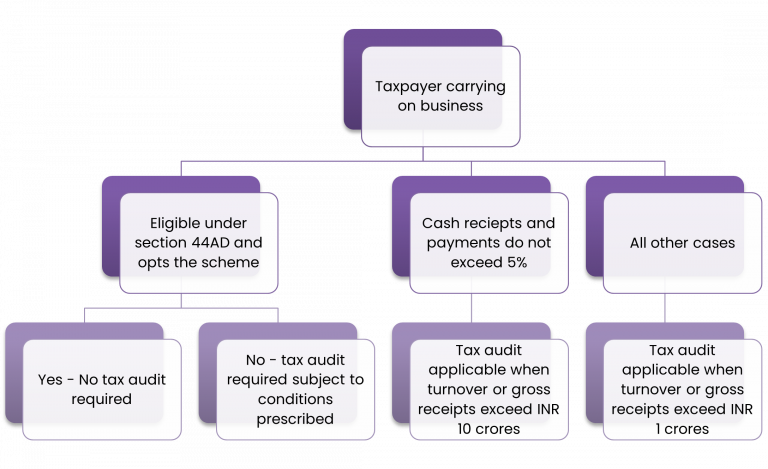

The applicability of tax audit post amendment for a taxpayer carrying on business w.e.f. AY 2021-22 is depicted below:

Other cases where tax audit becomes applicable:

- Business eligible for Presumptive Tax Scheme under Section 44AE, 44BB, 44BBB (i.e. presumptive scheme for specific businesses) and the taxpayer claims that his profits from business are lower than the profit computed under Section 44AE, 44BB, 4BBB accordingly.

- Profession eligible for Presumptive Tax Scheme under Section 44ADA and the taxpayer claims that his profits from profession are lower than the profits computed under Section 44ADA and total income exceeds the maximum exemption limit.

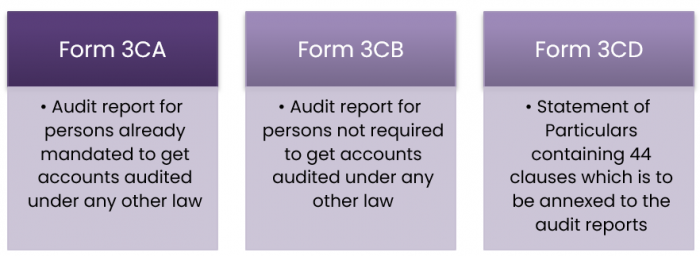

Prescribed forms for tax audit:

Due date for furnishing report:

The due date for filing tax audit report is the date one month prior to the due date of furnishing ITR.

- Assessees having entered international transactions – 31st October

- Other Assessees – 30th September

Consequences of non-filing of tax audit report:

Penalty under section 271B may be levied which is the least of the following:

- 0.5% of the turnover or gross receipts; or

- INR 1,50,000.