Mode of repayment of certain loans or deposits

August 7, 2020

Objective: This section regulates the repayment of loans or deposits or specified advance and similar to section 269SS.

Provision:

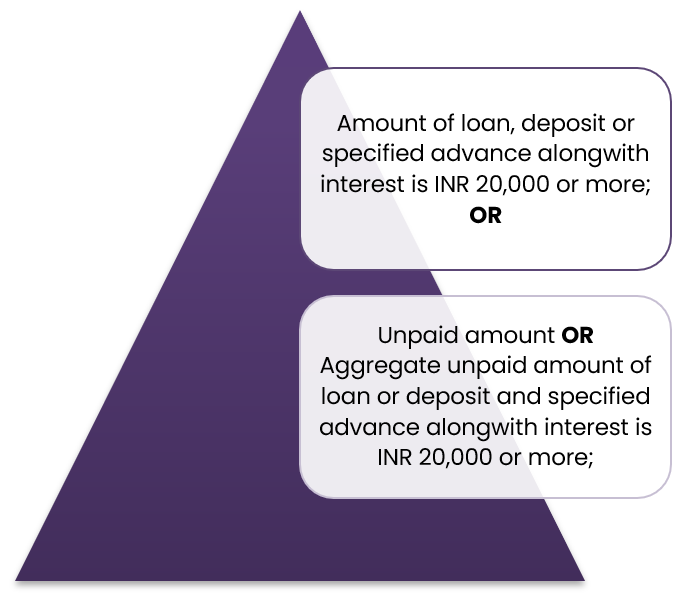

The amount alongwith interest should be repaid only by an account payee bank draft, account payee cheque or through electronic clearing system via bank account if,

“Specified advance” means any amount of advance in relation to transfer of immovable property.

Exceptions: The section shall not apply if the receiver OR payer are the following parties

-

- Government

- Banking company, post office savings bank or co-operative bank

- Corporation established by a Central, State or Provincial Act

- Government company

- Other institutions as notified by the Government

Consequences of violation: In case of violation, section 271E prescribes the penalty which is equal to the amount repaid.

Illustrations:

| Scenario | Date of repayment | Mode of repayment | Amount already o/s | Amount repaid | Balance O/s | Applicability of the section |

| A | 24-Sep-19 | Cash | 32,000 | 8,000 | 24,000 | Yes, on INR 8,000 |

| B | 14-Jun-18 | Cash | 20,000 | 10,000 | 10,000 | Yes, on INR 10,000 |

| C | 19-Oct-20 | Cash | 13,000 | 6,000 | 7,000 | No |

| D | 01-Jul-19 | Cash | 50,000 | 10,000 | 40,000 | Yes, on INR 10,000 |

| 01-Oct-19 | Cash | 40,000 | 15,000 | 25,000 | Yes, on INR 15,000 | |

| 01-Nov-19 | Cash | 25,000 | 1,000 | 24,000 | Yes, on INR 1,000 | |

| 01-Dec-19 | A/c payee cheque | 24,000 | 19,000 | 5,000 | No | |

| 30-Dec-19 | Cash | 5,000 | 3,000 | 2,000 | No |

Conclusion:

- In summary, it can be said that no person is allowed to repay loan, deposit or specified advance in CASH of INR 20,000 or more.

- The responsibility to comply with the section is on the ACCEPTOR of such loan, deposit or specified advance.